- Home

- Views On News

- Mar 20, 2024 - Sunil Singhania Picks a Promising Smallcap Stock for his Abakkus Fund

Sunil Singhania Picks a Promising Smallcap Stock for his Abakkus Fund

Retail investors often track the activity of big names in the stock market like Ashish Kacholia, or Vijay Kedia.

These investing gurus have a track record of successful investments and have gained a reputation as knowledgeable and experienced investors.

By following their investment strategies and stock picks, retail investors also hope to achieve similar success in the market.

In volatile markets like the current one, investors are actively scorching for such guru-verified stocks as filtering one among the whole lot makes the job much easier to be honest.

Today, let's look at one such stock that rallied over 8% today following a purchase activity from Sunil Singhania.

A Word about Sunil Singhania and Abakkus Asset Manager LLP

Abakkus Asset Manager is an investment management company founded by Sunil Singhania, who was the CIO of Equity Investments at Reliance Mutual Funds.

Sunil Singhania has a track record of over two decades in equity markets and he played an important role in building Reliance-Nippon MF into one of India's largest asset management companies (AMCs).

Which Smallcap Stock did Sunil Singhania Buy and Why?

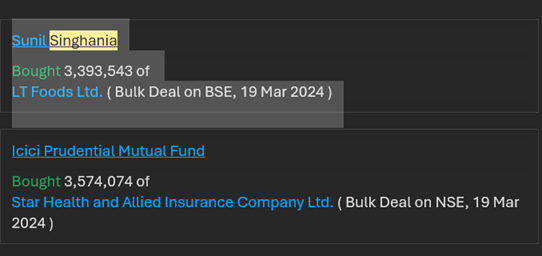

Bulk deal data revealed that the market mogul bought stake in LT Foods on Tuesday, 19 March 2024.

The transaction was carried out via the fund he manages Abakkus Fund.

In July 2023, the ace investor's PMS fund topped the list according to reports.

Coming back to LT Foods... his recent purchase...

While we don't know why Sunil Singhania decided to buy the dip in this smallcap stock, there are some reasons that we can guess...

In the past one year, the company has seen a sharp improvement in its financials aided by a growth in realisations from the rice business.

Realisations grew to Rs 95.8/kg compared to Rs 80.1/kg last year.

Due to higher free cash flows, the company was able to reduce debt on its balance sheet in the past few quarters, which led to lower interest costs.

Financial Snapshot

| Rs m, consolidated | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|

| Net Sales | 38,904 | 41,351 | 47,419 | 54,274 | 69,358 |

| Growth (%) | 8% | 6% | 15% | 14% | 28% |

| Operating Profit | 4,213 | 5,086 | 5,982 | 6,198 | 7,437 |

| OPM (%) | 11% | 12% | 13% | 11% | 11% |

| Net Profit | 1,265 | 1,845 | 2,740 | 2,922 | 4,027 |

| Net Margin (%) | 3% | 4% | 6% | 5% | 6% |

| ROE (%) | 11.0 | 14.2 | 17.9 | 16.5 | 17.8 |

| ROCE (%) | 12.3 | 13.7 | 16.2 | 16.1 | 19.1 |

| Dividend (Rs) | 0.2 | 0.5 | 1.0 | 1.0 | 1.0 |

| Debt to Equity (x) | 1.3 | 1.0 | 0.7 | 0.5 | 0.3 |

The Red Sea crisis affected its freight rates and transit time.

Going by its management commentary, the company has highlighted strong expansion plans. It's considering fundraising Rs 500 million through commercial paper.

Apart from that, the company commands a dominant market share in the industry, being the second-largest branded basmati rice player in India. It's also the largest selling basmati brand in the US with more than 50% market share in FY23.

Going forward, LT Foods plans to grow by expanding its footprint to new countries through its flagship brand Daawat.

Current trends such as higher spending capacity, increased in-house consumption and growing health awareness will support the company's expansion plans.

How LT Foods Share Price has Performed Recently

In 2024 so far, LT Foods share price has fallen over 13%. In the past one year, LT Foods has gained 81%.

Today, after investors took notice of the bulk deal developments, LT Foods share price rallied 8% to touch Rs 178.

LT Foods has a 52-week high of Rs 235 touched on 5 December 2023 and a 52-week low of Rs 90 touched on 29 March 2023.

Here's a table comparing LT Foods with its peers -

Comparative Analysis

| Company | LT Foods | Godrej Agrovet | Jubilant Foodworks | KRBL | Marico |

|---|---|---|---|---|---|

| ROE (%) | 17.8 | 12.9 | 17.8 | 16.1 | 37.4 |

| ROCE (%) | 19.1 | 12.7 | 32.2 | 21.1 | 45.2 |

| Latest EPS (Rs) | 16.5 | 17.4 | 3.3 | 26.2 | 11.3 |

| TTM PE (x) | 9.8 | 28.8 | 133.5 | 11.1 | 43.3 |

| TTM Price to book (x) | 1.8 | 3.9 | 13.8 | 1.4 | 13.8 |

| Dividend yield (%) | 0.6 | 1.9 | 0.3 | 0.3 | 0.9 |

| Industry PE | 58.8 | ||||

| Industry PB | 14.1 | ||||

About LT Foods

LT Foods is a food processing brand engaged in milling, processing, marketing, and manufacturing rice and value to rice food products.

It has a diversified rice product portfolio that includes white rice, brown rice, steamed rice, organic rice, parboiled rice, and quick cooking rice.

Its flagship brands, Daawat and Royal, enjoy leadership positions in India and the US. The company has several other brands of branded rice such as Ecolife and Devaaya to name a few.

LT Foods has a global footprint in over 65 countries across four continents. It has a network of over 1,200 distributors, 137 thousand retail outlets in India and over 1,000 distributors across the globe.

To know more, check out LT Foods financial factsheet and its latest quarterly results.

Happy Investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Sunil Singhania Picks a Promising Smallcap Stock for his Abakkus Fund". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!